S corp payroll tax calculator

Partnership Sole Proprietorship LLC. Per the IRS S corp owners are required to pay themselves a reasonable salary as an employee of their company.

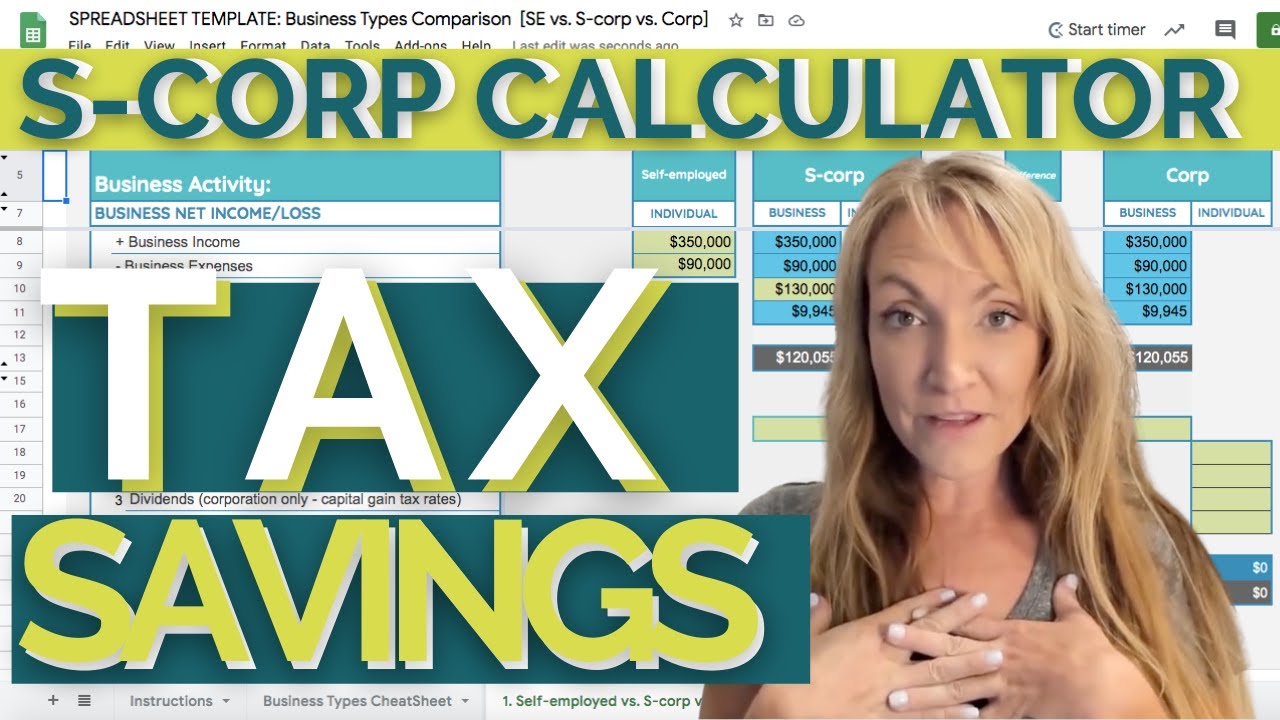

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

You also need to pay federal.

. 2020 Federal income tax withholding calculation. Annual cost of administering a payroll. Federal Bonus Tax Percent Calculator.

Forming an S-corporation can help save taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How to calculate annual income.

Set a reasonable salary. You the employee also need to pay a 765 payroll tax as an employee. If your corporation pays you payroll of 10000 thats another 765.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Annual state LLC S-Corp registration fees. Check each option youd like to calculate for.

The SE tax rate for business owners is 153 tax. As a reminder Social Security is 62 of an employees gross taxable wages paid by both the employer and employee. AS a sole proprietor Self Employment Taxes paid as a Sole.

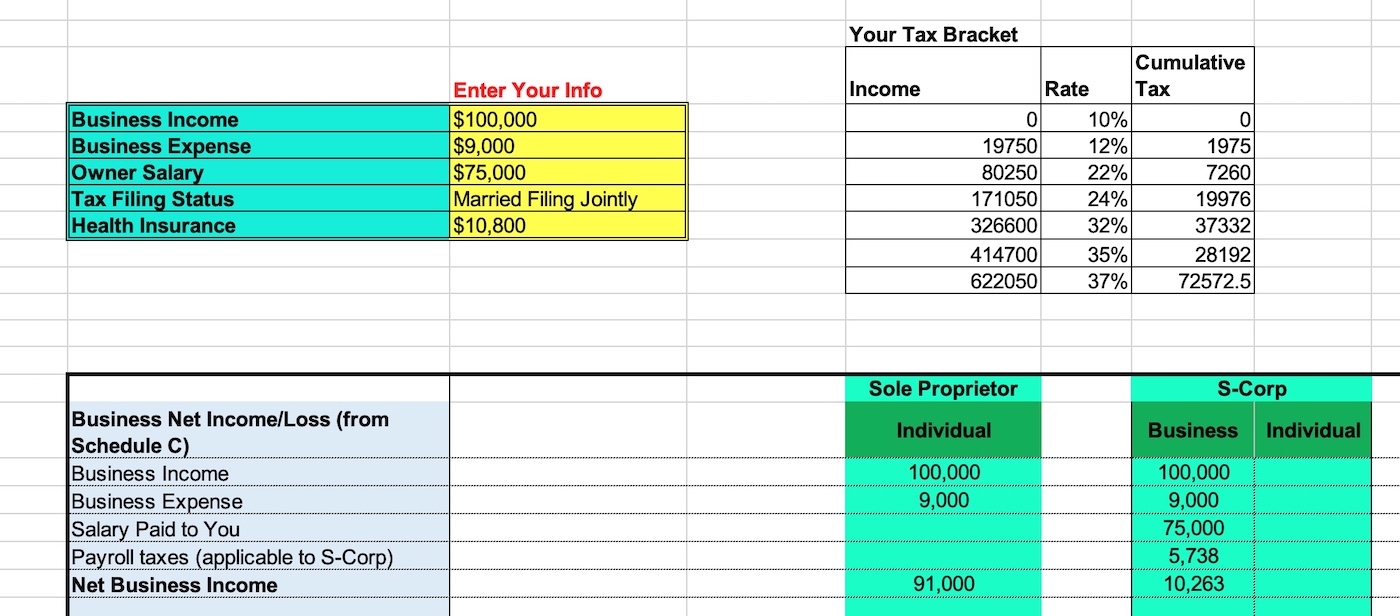

This calculator helps you estimate your potential savings. Heres how it works. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

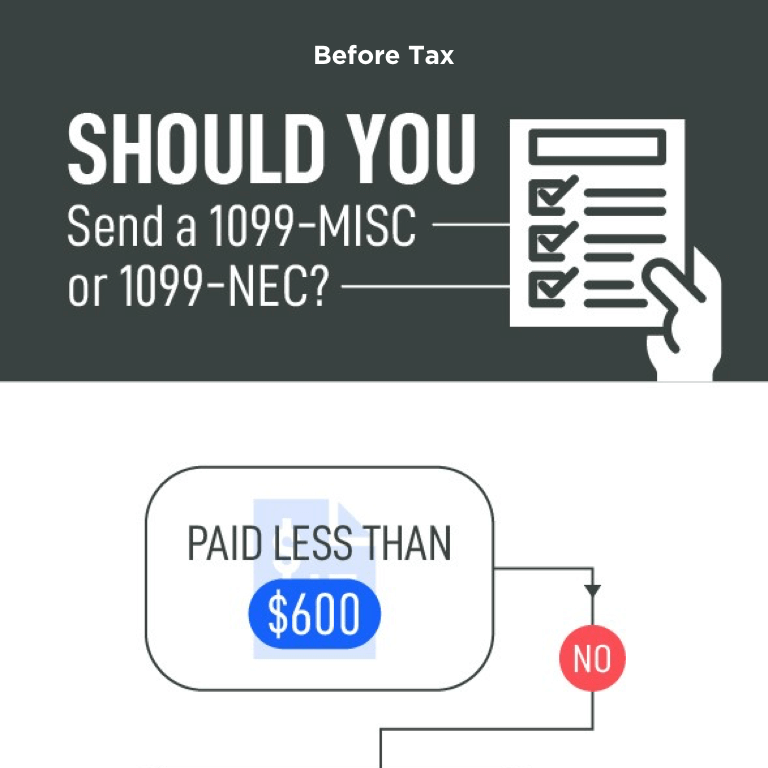

Estimated Local Business tax. From the authors of Limited Liability Companies for Dummies. S-corporation shareholder-employees must earn a salary thats comparable to what similar businesses pay.

This paycheck calculator can help you do the math for all your employee and employer payroll taxes and free you up to do what you do best. For example if an employee earns 1500. If your state does.

Total first year cost of S-Corp. Medicare is 145 of gross taxable wages paid by both. S-Corp or LLC making 2553 election.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Being paid as an employee means that your wages are subject. C-Corp or LLC making 8832 election.

We are not the biggest. The owners of the S corp pay income taxes based on their distributive share of ownership and these taxes are reported on their individual Form 1040. For example if the.

Subtract 12900 for Married otherwise. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Heres how paying an S corporation salary is done.

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Paycheck Calculator Take Home Pay Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

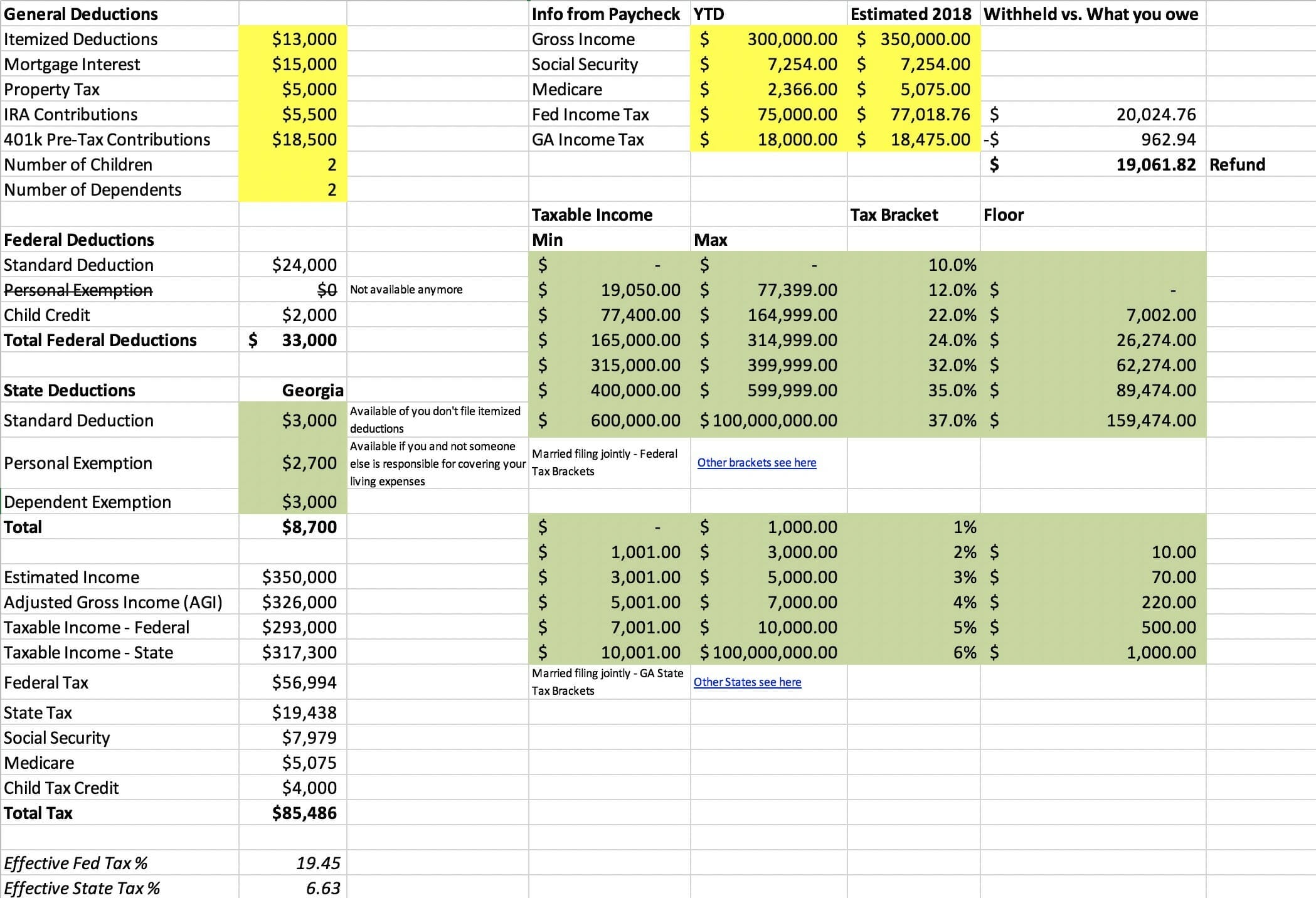

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Ruumojjagldbpm

S Corp Tax Savings Calculator

Solved W2 Box 1 Not Calculating Correctly

Employer Payroll Tax Calculator Incfile Com

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Payroll Taxes Requirements How To Calculate More

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator